OntarioTaxCalculator.ca Releases Updated 2025–26 Ontario Income Tax Calculator - Free and easy to use

OntarioTaxCalculator.ca Unveils Updated 2025–26 Ontario Income Tax Calculator to Support Workers, Freelancers, and Business Owners

Our goal is to make tax estimation accessible. The calculator is free, easy to use, and designed for anyone in Ontario who wants a clearer picture of their taxes.”

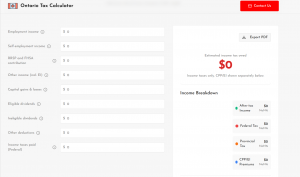

TORONTO, ONTARIO, CANADA, December 22, 2025 /EINPresswire.com/ -- As Canadians and Ontario residents prepare for the 2025–26 tax filing season, OntarioTaxCalculator.ca announces the launch of its newly updated income tax calculator designed to provide quick, accessible, and free estimates of tax owed and take-home income. The calculator helps individuals and business owners in Ontario better understand their tax obligations, including federal and provincial income tax, Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums, and Ontario Health Premiums—without requiring expert tax knowledge.— Creater

OntarioTaxCalculator.ca’s updated tool is now fully aligned with the most current tax legislation affecting the 2025–26 tax year, providing a valuable resource that helps taxpayers estimate their tax burden and plan accordingly. This free online service is ideal for T4 employees, freelancers, self-employed workers, contractors, and business owners who want to view potential tax owed before filing their 2025 tax return.

A Comprehensive Tax Estimator for Ontario Residents

Designed to be easy to use, OntarioTaxCalculator.ca’s tool allows users to enter their income from various sources—including employment income, self-employment earnings, investment income such as capital gains or dividends, and other taxable income. The calculator then produces an estimated tax bill and after-tax income total, giving individuals a clear snapshot of their financial picture for the year.

Because the calculator incorporates federal and Ontario provincial tax brackets as applied in 2025, users can see how different levels of income affect their overall tax liability. For instance, Ontario provincial tax brackets for 2025 range from 5.05% on income up to $52,886 to 13.16% on income over $220,000, while federal tax brackets start as low as 14.5% and climb to 33% on higher earnings.

The tool also factors in CPP and EI contributions and basic personal amounts, so taxpayers can estimate what they may owe after considering typical withholdings. This makes the calculator useful not only for planning, but also for understanding how take-home pay is calculated throughout the year.

Benefits for T4 Employees and Traditional Workers

For individuals who receive a T4 slip from an employer, OntarioTaxCalculator.ca provides a straightforward way to estimate their income tax obligations before they file their tax returns. T4 employees can enter their employment income and any other applicable income or deductions to see:

Estimated federal and provincial tax owed

Approximate after-tax (net) income

CPP and EI contribution breakdowns

Average and marginal tax rates

These results help individuals confirm that the tax deducted at source by their employer aligns with expectations and assists them in planning for possible refunds or additional amounts owed. This insight is particularly helpful ahead of Canada’s Tax Day deadlines

Helping Freelancers and Self-Employed Taxpayers

Freelancers and self-employed individuals often face more complex tax situations because their income is not subject to payroll deductions, and they must plan to cover their own tax payments. OntarioTaxCalculator.ca’s calculator enables self-employed users to:

Estimate estimated tax payments

Understand potential CPP contributions (which can be higher for self-employed earners because they pay both employee and employer portions)

Model outcomes for income earned at different levels

Compare after-tax income across scenarios

For workers who may earn income from a mix of employment and freelance work, the calculator offers a holistic view of combined tax obligations, helping users budget for taxes while running their own businesses.

Value for Small Business Owners and Contractors

Small business owners and independent contractors also benefit from OntarioTaxCalculator.ca as a planning tool. By entering business income and other financial details, owners can:

Estimate corporate or personal income taxes owed

Evaluate tax implications of salary versus dividend distributions

Compare scenarios for reinvesting income in the business

Forecast tax costs when planning expenses or expansion

While the calculator does not replace professional tax advice, it provides business owners with a starting point to evaluate tax obligations before consulting with accountants or tax professionals.

Why OntarioTaxCalculator.ca Is Useful Year-Round

Unlike many static online resources, OntarioTaxCalculator.ca enables interactive and dynamic calculations. Users can input various amounts related to income sources, deductions, and contributions to get up-to-date estimates tailored to their individual situations. Once results are generated, users can export the calculations to PDF for personal records, budgeting, or consultation with tax professionals

This flexibility means that OntarioTaxCalculator.ca is not just useful at tax time, but throughout the year. Whether planning for retirement contributions such as RRSPs and FHSAs or preparing for potential tax payments based on seasonal or gig economy income, users can test different scenarios quickly and efficiently

Easy, Free, and Secure

The OntarioTaxCalculator.ca calculator is free to use and does not require account registration, making it accessible to anyone who needs a fast tax estimate. Carefully updated with the most recent federal and provincial tax data for the 2025–26 fiscal season, the tool reflects current legislation as published by the Canada Revenue Agency (CRA) and the Ontario Ministry of Finance

While the results are estimates and individual circumstances vary, the calculator’s transparent approach allows users to understand major tax components without navigating complex tax tables or manual calculations. It represents a practical middle ground between high-level tax information and detailed professional software

Supporting Better Financial Decisions

Understanding tax liability is essential for financial planning, whether for individuals planning household budgets or business owners managing cash flow. By offering a quick and user-friendly solution for estimating taxes, OntarioTaxCalculator.ca empowers Ontario residents to:

Anticipate taxes owed

Model outcomes under different income levels

Compare financial scenarios

Plan payroll or estimated tax installments

Make informed decisions about savings and spending

This combination of accessibility and functionality makes OntarioTaxCalculator.ca a valuable resource for a wide range of taxpayers across Ontario

About OntarioTaxCalculator.ca

OntarioTaxCalculator.ca is an online tax estimation platform that provides free tools for calculating income tax owed and after-tax income for Ontario residents in the 2025–26 tax year. The service enables users across income types—employees, freelancers, entrepreneurs, and business owners—to estimate their income tax and deductions using current federal and provincial tax data.

For more information or to start calculating, visit https://ontariotaxcalculator.ca/.

Frank H

Vitality Calculators

email us here

Visit us on social media:

Instagram

2025-26 Ontario Tax Calculator

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.